अंकसमुद्र पक्षी संरक्षण रिज़र्व कहाँ स्थित है?

Sunday, June 8, 2025

Wednesday, June 4, 2025

EC introduces new tech-driven system to update voter turnout

The Election Commission (EC) on Tuesday said it had introduced a new tech-driven system to provide faster, real-time updates on voter turnout, addressing concerns raised by Opposition parties about discrepancies in turnout data. This system will be implemented before the Bihar Assembly election later this year.

Under this initiative, presiding officers at each polling station will enter turnout figures every two hours directly into the ECINET app on polling day to reduce the time lag in updating the approximate polling trends. This will be automatically aggregated at the constituency level.

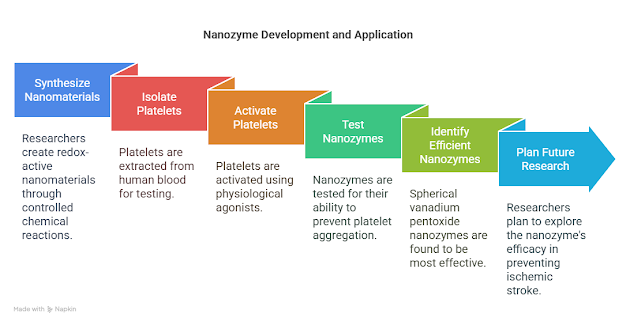

Artificial metal-based nanozyme that prevents excess blood clotting

Researchers at the Indian Institute of Science (IISc.) have developed an artificial metal-based nanozyme that can potentially be used to clamp down on abnormal blood clotting caused by conditions like pulmonary thromboembolism (PTE).

Tuesday, June 3, 2025

Monday, June 2, 2025

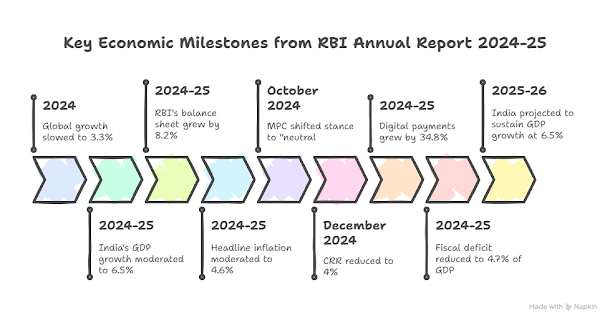

The Reserve Bank of India (RBI) released its Annual Report 2024-25

The Reserve Bank of India (RBI) released its Annual Report 2024-25, providing a comprehensive overview of the country's monetary policy, financial stability, regulatory initiatives, and key economic developments.

Global Economic Growth: Global growth slowed to 3.3% in 2024, below the historical average of 3.7% (2000-19). Growth in 2025 expected at 2.8% and 3.0% in 2026 amid geopolitical tensions, trade protectionism, and elevated public debt.

Global inflation moderated to 5.7% in 2024 from 6.6% in 2023, but

services inflation remained sticky in major advanced economies.

Indian Economy Resilience: India’s Gross Domestic Product (GDP)

growth moderated to 6.5% in 2024-25, yet it remained the fastest-growing major

economy globally.

Agricultural Gross Value Added (GVA) grew by 4.6% (up from 2.7% in

previous year), driven by record foodgrain production and favourable weather.

Industrial sector growth slowed to 4.3% and the services sector

remained strong with a 7.5% growth and accounted for 64.1% of GVA.

RBI Balance Sheet: As of

March, 2025, the RBI’s balance sheet grew by 8.2% year-on-year.

Its income rose by 22.77% (driven by a ~33% surge in forex

transaction gains and higher returns from investments), while expenditure

increased by 7.76%.

This led to a record surplus of Rs 2.68 lakh crore, up 27.37% from

Rs 2.11 lakh crore in the previous year.

On the assets side, gold rose by 52.09%, domestic investments by

14.32%, and foreign investments by 1.70%.

Liabilities expanded due to higher notes issued, revaluation

accounts, and other liabilities.

As of March, 2025, foreign assets (including gold and loans) made

up 74.27% of total assets, with domestic assets at 25.73%. Gold holdings rose

by 57.48 metric tonnes to 879.58 metric tonnes.

Inflation Trends: Headline inflation moderated to 4.6% in 2024-25

from 5.4% in 2023-24.

Core inflation stood at 3.5%, with food inflation falling to 2.9%

by March 2025.

Fuel prices saw deflation of 2.5% due to softer global energy

prices.

Monetary Policy and Liquidity: The Monetary Policy Committee (MPC)

maintained the repo rate at 6.50% through much of 2024-25 but shifted the

stance from “withdrawal of accommodation” to “neutral” in October 2024.

The cash reserve ratio (CRR) was reduced to 4% in December 2024 to

ease liquidity pressures.

External Sector: Merchandise exports grew marginally by 0.1%, while

imports rose by 6.2%, widening the trade deficit to USD 282.8 billion.

Current Account Deficit (CAD) remained manageable at 1.3% of GDP.

Foreign exchange reserves stood at USD 668.3 billion, covering 11 months of

merchandise imports.

Increased Household Savings: Net household savings increased to

5.1% of Gross National Disposable Income (GNDI) (measures the income available

to the nation for final consumption and gross saving) in FY24.

Financial Sector Health: Bank credit growth outpaced deposit

growth, improving credit-to-deposit ratio slightly.

Gross Non-Performing Assets (NPA) ratio and Net NPA ratio declined

further. Urban Cooperative Banks (UCBs) showed improved credit growth and lower

GNPA ratios.

Digital Payments and Financial Inclusion: Digital payments volume

grew by 34.8%, value by 17.9% in 2024-25.

Unified Payments Interface (UPI) accounted for 48.5% of global

real-time payments by volume.

The RBI’s Financial Inclusion Index rose from 60.1 in 2023 to 64.2

in 2024, reflecting deeper usage of financial services.

Efforts to boost financial literacy continued through initiatives

like Financial Literacy Week 2025, and new campaigns for children featuring

mascots “Junior Money” and “Mini Money.”

Consumer grievance redressal was also strengthened with expanded

RBI Ombudsman offices and a nationwide financial awareness drive.

Regulatory and Technological Initiatives: RBI introduced ‘bank.in’ domain to enhance digital banking

security, and expanded the Central Bank Digital Currency (CBDC) pilot to 17

banks and 60 lakh users.

RBI launched the FinTech Repository and EmTech Repository to track

tech adoption by FinTechs and regulated entities. Managed by RBI Innovation

Hub, these platforms capture data on

technologies like Machine Learning and Artificial Intelligence, aiding policy

and industry insights.

Fiscal Situation: Gross Fiscal Deficit (GFD) of the central

government reduced to 4.7% of GDP in 2024-25 from 5.5% in 2023-24.

Capital expenditure grew by 5.2%; revenue expenditure grew by 5.8%.

States’ consolidated fiscal deficit is likely to remain within 3.2% of GDP.

Outlook for 2025-26: India projected to sustain GDP growth at 6.5%

with risks balanced.

Inflation expected at 4.0%, with easing supply pressures but upward

risks from global uncertainties.

The central government aims to reduce the fiscal deficit to 4.4% of

GDP in 2025-26 and target a declining public debt-to-GDP ratio reaching 50% by

2031.

What are the Challenges Highlighted in RBI Annual Report 2024-25?

Counterfeit Notes: Although overall fake note detection has

declined, counterfeit Rs 200 and Rs 500 notes rose by 13.9% and 37.3%

respectively, requiring continued vigilance.

Surge in Bank Fraud Amounts: The RBI highlights a sharp rise in

bank fraud amounts, which nearly tripled to Rs 36,014 crore despite fewer cases

reported.

This surge is largely due to reclassification and delayed reporting

of old frauds.

Public sector banks saw the highest fraud values, mainly in loan

portfolios, while private banks reported more cases, mostly digital payment frauds.

Card/internet frauds decreased in value but remained common by number.

Global Uncertainties: Rising protectionism, and geopolitical

tensions (e.g., Russia-Ukraine) risk destabilizing trade and causing market

volatility.

Evolving US tariff policies and reciprocal actions by other

countries may cause sporadic market volatility.

Inflation Management: Inflation management faces challenges as

rising input costs and weak global demand threaten India’s industrial growth.

While headline inflation eased, volatile food prices continue to slow

disinflation.

Fiscal Consolidation and Capital Expenditure Balancing: GFD reduced

to 4.7% of GDP in 2024-25, but this requires balancing fiscal consolidation

with the need for increased capital expenditure to boost growth.

Capital expenditure grew by 5.2% in 2024-25 but still requires

further enhancement to sustain growth momentum.

Climate Change and Sustainability Risks: Increasing climate shocks

threaten agricultural productivity and food price stability. Efforts to expand

renewable energy and green technology adoption are ongoing but require scaling

to meet long-term sustainability goals.

What Measures are Needed for India’s Economic Growth and Financial

Stability?

Controlling Food Inflation: Strengthen agri-logistics infrastructure, including cold chains and warehousing, to reduce post-harvest losses and curb perishables-driven price spikes.

Implement forecast-based Minimum Support Price planning and ensure

timely buffer stock releases to stabilize prices during seasonal supply shocks.

Enhancing Financial Sector Resilience: Intensify fraud detection

and prevention through RBI’s Mulehunter AI and advanced digital forensic tools,

especially in public sector banks and digital payment systems, to safeguard

trust and stability.

Implementing advanced fraud detection technologies using AI/ML, as

facilitated by the RBI Innovation Hub’s EmTech Repository, will be pivotal.

Harnessing Digital Innovation: Scaling the CBDC pilot to enhance

transaction efficiency, reduce cash dependency, and tighten anti-money

laundering controls aligns with the future of digital finance.

External Sector Diversification: Active engagement in multilateral

trade agreements and bilateral partnerships can reduce vulnerability to

protectionist shocks and geopolitical risks .

Maintaining robust forex reserves ensures external buffers against

volatility.

Quality Capital Expenditure: A paradigm shift towards higher

capital expenditure (which grew by 5.2%) focused on infrastructure, green

energy, and digital connectivity is critical for long-term productivity gains.

Improving public financial management through outcome-based

budgeting and digital governance will enhance expenditure efficiency and

transparency.

Climate Adaptation and Green Financing: Green finance instruments,

including issuance of green bonds by banks and incentivizing ESG-compliant

investments, align with India’s COP26 commitments and sustainability goals.

Integrating climate risk assessment into banking supervision and

credit appraisal will reduce systemic risks.

Conclusion

The RBI Annual Report 2024-25 highlights the need for India to balance

robust economic growth with financial stability amid global uncertainties.

Strategic focus on inflation control, fostering digital innovation, and

prioritizing quality capital expenditure will be crucial. Additionally,

addressing climate risks with green financing and adaptive policies will ensure

long-term sustainability, helping India tackle challenges while advancing

growth and development.

Mosura fentoni

Mosura fentoni, a Cambrian-era (541 million to 485.4 million years

ago) sea creature from Canada’s Burgess Shale, challenges existing views on

arthropod evolution with its advanced swimming and respiratory adaptations,

hinting at the rise of modern insects and crustaceans.

About: Mosura fentoni is a small but highly specialized radiodont, a primitive relative of modern arthropods (insects, crabs, spiders).

Anatomy: It had a segmented body with a short neck, six

paddle-shaped flaps for swimming, and a posterotrunk featuring gills for

respiration.

The posterotrunk functioned as a specialized respiratory tagma,

resembling the oxygen-collecting tails of horseshoe crabs.

It shows early segment specialization, crucial for arthropod

diversity.

Radiodonts: Radiodonts were ancient marine predators from the Cambrian period and are early relatives of arthropods like insects and crabs, though not their direct ancestors.

Burgess Shale is a renowned fossil site in Canada dating to the

Cambrian period.

What challenges do gig workers face?

What challenges do gig workers face? Gig workers face several challenges, primarily revolving around the nature of temporary, project-based...

-

UPSC Prelims 2025 Answer Key GS Paper 1 – UPSC Prelims 2025 Solution GS Paper 1 Question 1. Consider the following types of vehicles...

-

Q How will India effectively address the growing economic and social burden of dementia? Ans Addressing the growing economic a...

-

Here are some tips for preparing for daily current affairs for the UPSC exam: · Read newspapers : Choose a newspaper that cover...